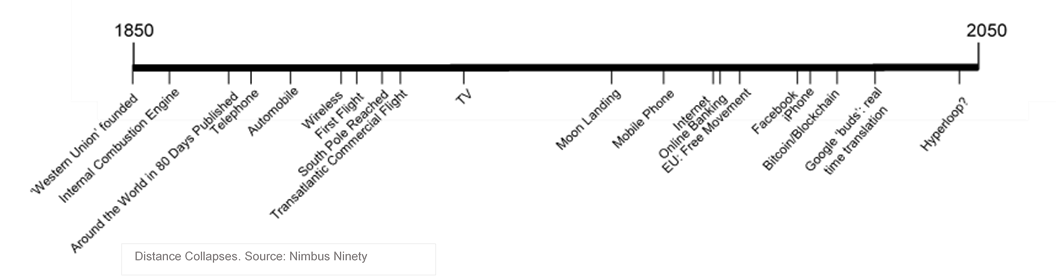

The collapse of distance is perhaps the most politicised technological trend. Travel is now brief; communication, instant. Economic globalisation has too many consequences for wealth and its distribution to list; and over the 1990s, immigration to the UK increased substantially.1 Technologies such as real-time translate earphones, or global freelance marketplaces enabled by smart contracts, will soon be implemented.

For the individual, tech has created the expectation of worldwide frictionlessness, politics notwithstanding; ease of existing across vast distances is considered normal. For that reason it can be extremely frustrating when antiquated players monetise distance which isn’t really there.

THE FUTURE IS HERE, IT’S JUST NOT EVENLY DISTRIBUTED

Remittance flows from developed to developing countries were estimated to be $432 billion in 2015, not including the substantial informal market.2 30% of Liberia’s GDP is made up of remittances from overseas.3 In Somalia, it could be as high as 50%.4But the fees are extremely high – often around 10%. (That’s just the fee; there is also the exchange rate). According to the World Bank, the timescale varies from ‘less than an hour’ to ‘next day’ to collect the money, depending on the provider.5

These people are being ripped off. They earn low wages, of which they donate a substantial portion to their family; only for those donations to incur 10% in fees. In a 2015 summit, European and African leaders set a target to shrink the cost of remittances to 3% by 2020.6 But where blockchain is used and the third parties charging aren’t needed, remittances could be free. They could also be instant. Communications are instant, and there is no technical reason that sending money should be slower than sending an email.

Many of the potential disruptors here (‘rebittance’) are crypto-currency based: for example, digital cash wallets. The barrier to use is internet access, but this is certainly a lower barrier than having a bank account. (In countries where sexist laws prevent women from holding bank accounts, these wallets could provide a valuable means of independence.) Across Africa, smartphone adoption is increasing, and penetration will soon reach 50%.7

Their adoption is slow. Cash is “sticky”: for remittances that come from the UK, cash-to-cash payments are still used over digital-to-cash payments, despite the latter being considerably cheaper. Blockchain, which is considerably more arcane than using a website, could take longer to see adoption despite its competitiveness. One challenge is educating people about the opportunities; another is finding reasonable exchanges for crypto at the receiving end, as these exchanges are not yet as widespread as they are for other currencies.

But where an established digital protocol wins, it could win big. In an interview this September, Christine Lagarde of the IMF contemplated the possibility of countries with weak currencies/institutions undergoing a crypto ‘dollarisation 2.0’ – in developing countries, low level of cryptocurrency adoption now could skyrocket when a critical threshold is reached. She observed that, ‘in the Seychelles, for example, dollarisation jumped from 20% in 2006 to 60% in 2008.’8 In countries where a third or more of the national GDP is made up of remittances, a shift to crypto is strongly incentivised by the market – the thin end of the wedge.

Meanwhile, in the developed world, banks are being dragged kicking and screaming towards a more competitive environment for consumers, including transactions abroad. Legal changes from a few years ago which made it easier to set up a new bank are now bearing fruit.

The UK “challenger bank” Monzo initially offered foreign ATM withdrawals abroad for free, but they then held a vote on how to charge users for these transactions because they were incurring fees from the ATM owners.9 (They initially absorbed these fees themselves). But with mobile and card payments, and free POS transactions, who needs ATMs?

Along with mobile phone charges, disproportionate fees abroad from banks seem less to do with technological necessity and more to do with monopoly advantage and calculated leverage, like the cost of a sandwich in a train station.

This is surely the next chapter in the collapse of distance. Cross-border frictionlessness must catch up as people lead increasingly global lives; and not even banks can be powerful enough to monetise distance which is no longer there. It is now possible to live one's life without reilance on a bank. The option to bypass financial service providers will hopefully hold them to a higher standard of consumer service; moving money abroad is one example.

Enjoy this post? Consider subscribing to our popular weekly newsletter. Subscribe here or see and example here.

1Hawkins, O.,'Briefing Paper: Migration Statistics' [House of Commons Briefing Paper] October 2017.

2FSD Africa: 'Reducing Costs and Scaling Up UK to Africa Remittances through Technology'. June 2017. [Online]. Available: http://www.fsdafrica.org/wp-content/uploads/2017/06/Scaling-up-Remittances-15.06.2017_Final.pdf [Accessed 20/10/2017]

3World Bank, 'Remittance Inflows to GDP for Liberia', retrieved from FRED, Federal Reserve Bank of St. Louis. Available: https://fred.stlouisfed.org/series/DDOI11LRA156NWDB [Accessed 20/10/2017]

4FSD Africa: 'Reducing Costs and Scaling Up UK to Africa Remittances through Technology'. June 2017. [Online]. Available: http://www.fsdafrica.org/wp-content/uploads/2017/06/Scaling-up-Remittances-15.06.2017_Final.pdf [Accessed 20/10/2017]

5World Bank, 'Remittance Prices.' [Online] Available: http://remittanceprices.worldbank.org/ [Accessed 20/10/2017]

6Crossman, P., 'Why Remittances Cost So Much and How to Make Them a Lot Cheaper.' American Banker, February 2016. [Online]. Available: https://www.americanbanker.com/news/why-remittances-cost-so-much-and-how-to-make-them-a-lot-cheaper

7Dahir, A. 'Smartphone use has doubled in Africa in two years.' QZ. August 2016. [Online]. Available: https://qz.com/748354/smartphone-use-has-more-than-doubled-in-africa-in-two-years/

8Lagarde, C., 'Central Banking and Fintech - A Brave New World?' IMF. September 2017. [Online] Available: https://www.imf.org/en/News/Articles/2017/09/28/sp092917-central-banking-and-fintech-a-brave-new-world [Accessed 10/10/17]

9Monzo. 'ATM fees abroad: asking the Monzo community to decide pricing'. September 2017. [Online]. Available: https://monzo.com/blog/2017/09/13/atm-fees-abroad/ [Accessed 10/10/17]

Leave a Comment