|

2023: A Challenge or an Opportunity for Financial services perceive more risk Financial Services Strategy in 2023 Financial Services Mindset in 2023 |

As the community for disruptive business and technology leaders, Chief Disruptor has been a forum for assessing, evaluating and debating the impact of disruption on organisations for more than 17 years. Whether it is disruptive technologies, innovative business models or, more recently, external market challenges, we have been fortunate enough to gain unique insight from members, partners, speakers, academics, journalists and others into the forces shaping how we live and work.

And, as a Researcher at Chief Disruptor, I am delighted to introduce a new blog series exploring the findings of our 2023 Disruptive Trends Report through the lens of different industries. Combining data from 400 business and technology leaders with qualitative insights from our C-level community, I will pull together some of the key driving forces of change, the impact of external market challenges and the disruptive strategies, mindsets and technologies across different industries in 2023.

The aim of this blog, therefore, is not to offer up any unsolicited advice or sweeping conclusions. Instead, I want to offer up food for thought grounded in qualitative and quantitative insights from those at the coal face to encourage industry leaders to evaluate, debate and compare their business objectives and technological initiatives for 2023 and beyond. It is pertinent to add that whilst the stats and facts below offer up interesting insights, we always need to consider the size of datasets and avoid drawing firm conclusions and generalisations. In this first blog article, I focus on one of the most heavily disrupted industries in the UK over the last 3 years: financial services.

2023: A Challenge or an Opportunity for Financial Services?

Before the 2007-2008 global financial crisis, financial services would not have been an industry synonymous with disruption. Interest rates, the cost of borrowing and the reward for saving, kept financial service organisations grounded in traditional models. As such, the global financial crisis, and the associated decrease in interest rates, acted as a catalyst for massive disruption in the industry. Disruptors, fintech, insurtech and the like, were able to benefit from access to cheap capital, innovative business models and new operating models. Meanwhile, large incumbents faced reform and regulation of financial markets, lacking the agility to pivot and adapt to market challengers and compete for customers. The result is that for much of the 21st Century, the foundations of the financial service industry have been disrupted.

One of the key driving forces of disruption within financial services has been customer trust and loyalty. Customer trust equates to savings deposits, loans, policies, investments and mortgages and, in turn, both growth and financial performance. And whilst customer relationships have been recovering since the global financial crisis, growing cybersecurity threats and data breaches have dented customer trust and loyalty. In fact, a 2020 report showed that cyberattacks against financial services grew more than 200% between February 2020 and the end of April 2020 alone. Mitigating and managing cyber risk has become a key task of business and technology leaders within financial services.

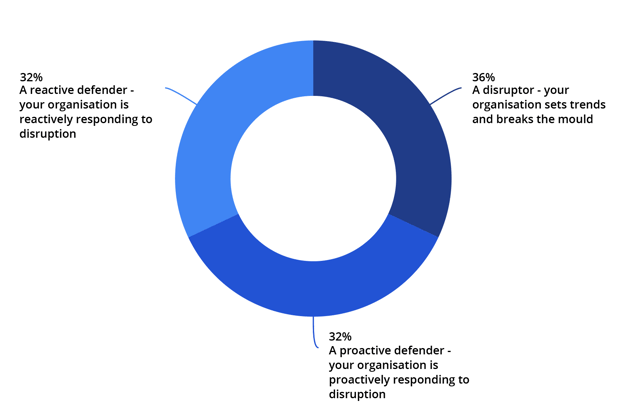

Fig. 1: Thinking about your organisation's approach to change, would you class your organisation as:

Financial Services

Respondent Rate

It is, therefore, no surprise to see in our 2023 Disruptive Trends Report that when asked to evaluate their organisation's approach to change, survey respondents from financial services are more likely to identify as reactive or proactive defenders rather than disruptors when compared to the overall respondent rate. This suggests recent levels of uncertainty, and low appetite for risk, hinders levels of innovation and disruption within much of the industry.

However, in 2023, a new, more complex picture is emerging, with economic uncertainty driven by inflationary pressure and interest rates rises. Whilst interest rate hikes often signal growth in profitability for commercial and retail banks, investment banks and other financial institutions, this picture is not one-size-fits-all. For instance, inflationary pressure means insurers face claims inflation and, as we have seen with recent events surrounding the Silicon Valley Bank and then Credit Suisse, faltering confidence in markets can have a drastic impact on organisations. Meanwhile, financial services also face the challenge of supporting customers, whether it is those struggling with the cost of living crisis or greater interest payments. In short, these novel market conditions signal a whole host of opportunities and challenges for financial services, not least in the technology and digital transformation space.

In fact, according to many experts and Chief Disruptor members, the result of these changes will be a focus on technology-led innovation and disruption as a source of growth. In fact, recent cases of disruptive technology adoption suggest financial services are well-prepared to do this. For instance, the growing demand for online services, as well as the need to support remote working during the Covid-19 pandemic, massively accelerated investment and adoption of cloud computing. Additionally, the adoption of open banking in 2017 in the UK has seen a number of API-driven innovations benefit customers, businesses and financial service providers. A successful track record of digitalisation and disruptive technology adoption is arguably the foundation for wide-scale digital transformation and a shift to “digital-first” financial services.

In many cases, this vision is clear. For example, JPMorgan Chase’s CFO, Marianne Lake, famously announced as far back as 2016, ‘we are a technology company’. However, 7 years later the reality is very different. According to the ECB in 2023, only a fifth of IT budgets within financial services is allocated to digital transformation efforts. And, according to a survey of 100 banks measuring cloud adoption, only 15% of overall workloads are on the cloud. Digital transformation, not least during turbulent economic and political times, also introduces significant levels of cyber risk that could damage an organisation’s reputation and result in a mass exodus of customers to more digitally advanced competitors. Not to mention, these initiatives require the right people with the right skills and trusted technology partners.

2023 represents both an opportunity and a challenge for financial services and our survey responses below provide a fascinating snapshot of how technology and business leaders are responding.

Financial services perceive more risk than other industries

Within our 2023 Disruptive Trends Report, financial services include those respondents that identified their organisation as “Banking/Financial Services” or “Insurance”. Of the 66 respondents from financial services, the majority (73%) came from large and extremely large organisations (ranging from 1000+ to 25000+). Furthermore, roughly 50% of the respondents from financial services were C-level executives or VP-level decision-makers.

As seen above, financial service leaders face unique trends, challenges and opportunities when it comes to disruption. For the first time, our Disruptive Trends Report explored the risk factors facing organisations in 2023. When looking at the data through the lens of financial services, the results provide an intriguing insight into the specific challenges facing organisations in the industry.

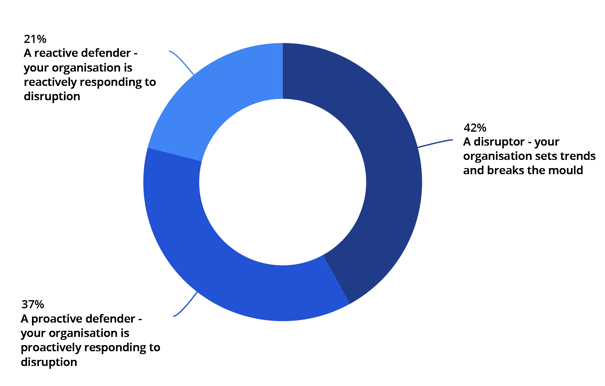

Figure 2: A graph to show the disruptive impact of risk factors facing financial services in 2023 (rated as disruptive or above)

Looking at figure 2, it is first worth noting that respondents from financial services (in orange) rated all the risk factors (economic, technology, political, socioeconomic, environmental and legal) as being more disruptive to their business in 2023 than the overall respondent rate (in blue). In short, the results suggest that respondents perceive that there are more risks facing financial services than other industries, supporting much of the analysis above.

Going into more detail, the risk factor ranked as most impactful to financial services in 2023 was ‘economic risk’ with 80.3% of respondents rating it as ‘disruptive’ or ‘very disruptive’. This is unsurprising given the economic uncertainty within the global economy; a result of inflationary pressures, growing interest rates and recession which heavily impact financial markets.

Continuing down figure 2, ‘technological risk factors’ was ranked as the second most impactful risk factor for financial services, at 64% of respondents. One interpretation of this trend might be that, in spite of recent events such as cryptocurrency crashes and scandals, technologies, such as blockchain, distributed ledgers and fintech, represent a serious challenge for financial services. On the other hand, ‘technological risk factors’ might also reflect the growing cybersecurity and data breach threats, with financial services being a key target for cybercriminals. According to a 2022 survey published by the Bank of England, cyber-attacks represent the biggest risk to the UK financial system.

Elsewhere, ‘environmental’ and ‘legal’ risk factors are perceived as a greater threat to financial services when compared to the overall respondent rate. The former statistic highlights not only the emphasis on all sectors to strive for net zero themselves, but also the expectation of financial services to use their unique position to address consumption-based emissions and, in part, finance a green transition. The disruptive perception of ‘legal risk factors’ is perhaps a result of regulatory changes such as a new Consumer Duty or the Financial Services and Markets Bill.

So how are business and technology leaders within financial services responding to and combatting these external market challenges? The following graphs highlight the response, in terms of strategy, mindset and technology, for 2023.

Financial Services Strategy in 2023

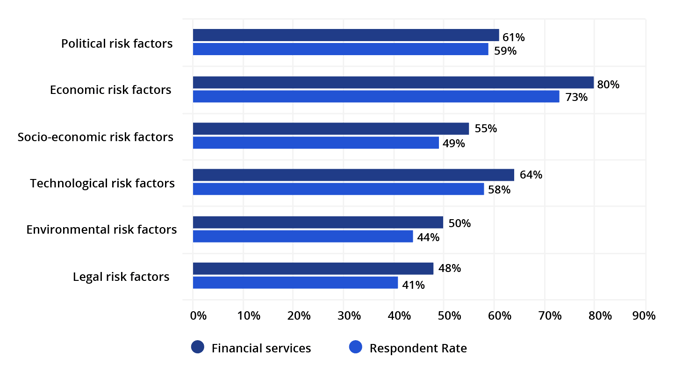

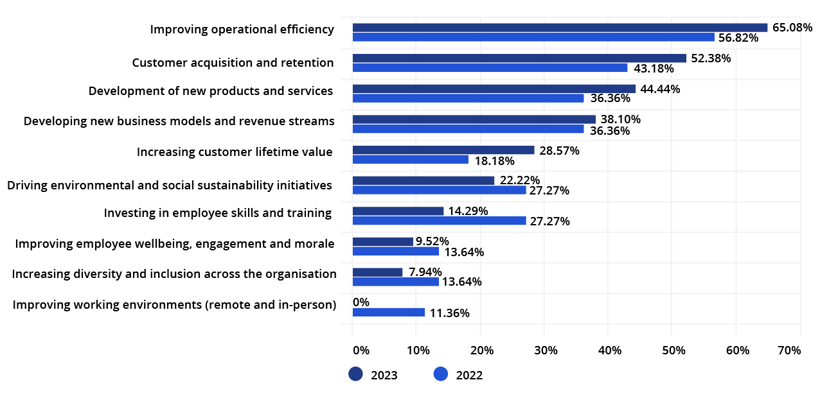

Figure 3: A graph to show the top 3 business goals for business and technology leaders within financial services for 2023

According to data from the 2023 Disruptive Trends Report, the top business goals for financial services are “improving operational efficiency” (65%), “customer acquisition and retention” (52%) and “development of new products and services” (44%).

When looking at Figure 1, it is worth highlighting the business goals where there is a significant disparity between financial services and the overall respondent rate. Firstly, the top business goal, “improving operational efficiency”, was chosen by 65% of financial services compared to the 52% chosen by all respondents. “Customer acquisition and retention” and “increasing customer lifetime value” also share this trend; being identified as more important business goals for financial services than others industries in the survey. In contrast, “developing new business models and revenue streams” and “development of new products and services” are seen as less important business goals for 2023 by financial services when compared to other industries.

Figure 4: A year-on-year analysis of business objectives within financial services

When we take a look at year-on-year data in figure 3, it is interesting to note that whilst the top 3 objectives have not changed between 2022 and 2023, it’s clear organisations are adding greater emphasis, with each objective experiencing at least an 8% growth from 2022 to 2023. It is also worth highlighting that “increasing customer lifetime value” has gained priority as a business goal in 2023, seeing a 10% growth.

In contrast, the business goals which have seen the largest decline between 2022 and 2023 are “driving environmental and social sustainability initiatives” and “investing in employee skills and training”.

Financial Services Mindset in 2023

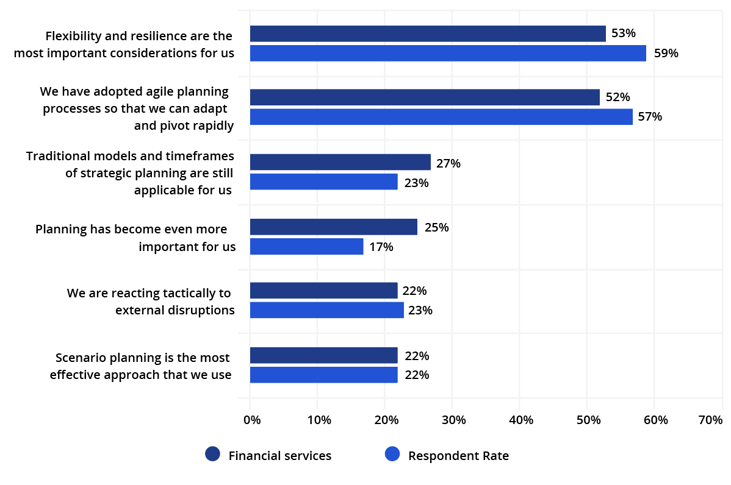

Figure 5: In the current volatile and uncertain macroeconomic environment, how would you describe your organisation’s approach to planning? (Choose Two)

In the figure above, we can see that, in general, financial services are adopting a similar approach to planning in 2023 to the other industries featured in our survey. As seen in the respondent rate, “flexibility and resilience” and “agile planning processes” are the approaches to planning that are most popular amongst financial services given the volatile and uncertain environment.

Looking at the other approaches to planning, it is interesting to see that “traditional models and timeframes” are more popular in financial services than in the rest of the respondents. This perhaps reflects the traditional approach to innovation and disruption of many financial services referenced in the introduction. Furthermore, “planning has become even more important” to financial services. In fact, financial services have the largest proportion of respondents that have selected this planning approach of any sector in the report; arguably, reflecting the economic uncertainty facing the industry mentioned above.

Financial Services Technology in 2023

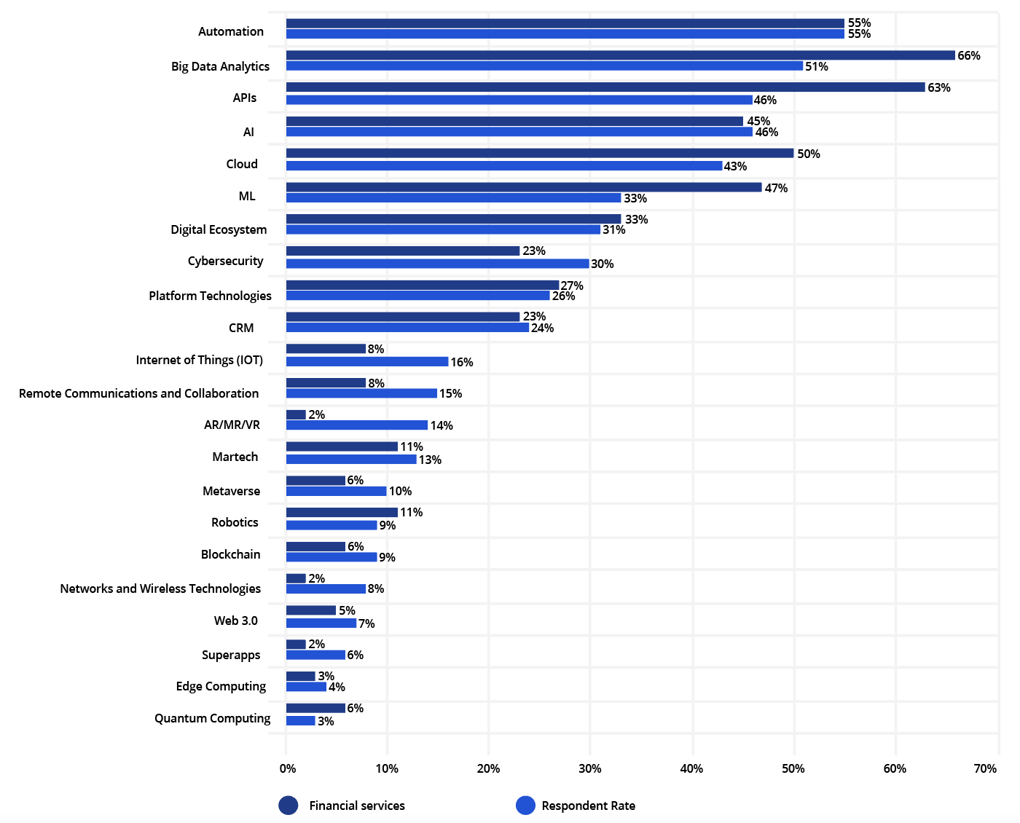

Figure 6: Which of the following technologies will be most important in helping you combat external market challenges? (Pick top five)

As seen in Figure 6, when asked to select the technologies that will be most important to combat external market challenges, financial services’ top five technologies were Big Data Analytics, APIs, Automation, Cloud and Machine Learning (ML) compared to Automation, Big Data Analytics, Artificial Intelligence (AI), APIs and Cloud amongst the respondents as a whole.

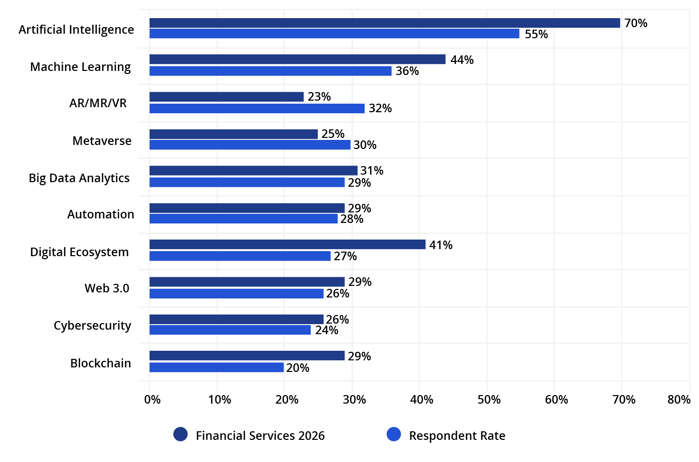

As a follow-up question, our survey asked members to evaluate the same technologies in terms of disruptive potential in 2026. Financial services’ top five disruptive technologies in 2026 were AI, ML, Digital Ecosystems, Big Data Analytics and Web 3.0, Automation and Blockchain in joint fifth compared to Artificial Intelligence, Machine Learning, AR/VR/AR, Metaverse and Big Data Analytics (see Figure 7).

Figure 7: Which of the following technologies are likely to have the greatest disruptive impact on your business model? (Pick top five for 2023)

What have we learnt from the Chief Disruptor Community?

So what can we take from all these stats and graphs? Well here are 4 of my personal takeaways and reflections. Let me know if you agree or disagree.

- The level of disruption in the external environment appears to be causing a shift towards more flexible, resilient and agile ways of planning. External pressures and uncertainty, whether economic, technological or geopolitical, demand a greater ability to pivot and adapt business and operating models supported by technologies such as cloud and data-driven insights. However, with the perfect storm of geopolitical and economic instability, governance, regulation and risk management are likely to be top priorities; confining financial services within the constraints of traditional planning.

- As a result of interest rate increases, business and technology leaders will focus on optimising customer experience. To navigate uncertainty, financial services are competing for customers whether it’s commercial banks seeking the deposits of institutional investors down to the everyday saver, or insurtechs seeking new customers. As seen in figure 2, respondents are focusing on this with “customer recruitment and retention” and “increasing customer lifetime value” rising up the agenda for respondents. To do this, organisations, with disruptors at the fore, will supercharge their product innovation and “develop new products and services” with the help of technologies such as Big Data Analytics, AI and APIs capable of creating innovative new solutions and personalised, seamless customer experiences.

- Due to continued disruption and uncertainty, financial services are also focusing on “increasing operational efficiency” through end-to-end digital transformation. To achieve this, as seen in figure 5, financial services are seeking to modernise their core technologies and processes which have historically been overlooked for smaller projects. In particular, Cloud and Big Data Analytics will act as a foundation for building new digital capabilities and unlocking technology-driven competitive advantage. Automation will also play a large role in achieving operational efficiencies. Here, technology and information leaders are becoming crucial business partners for not just maximising bottom-line growth but also leading on wide-scale business transformation to “digital-first” organisations.

- Looking forward, AI and ML will increasingly become a driving force of competitive advantage for business and technology within financial services. AI and ML, of course, already play a massive role within financial services in fighting financial crime, managing risk, trading, compliance as well as other use cases. But, as we see the emergence of generative and conversational AI, the use cases for leveraging AI for customer experience, data science and business transformation will expand. Whilst figure 6 highlights this perfectly, with AI predicted to be a front-runner in 2026, many suggest that this will be too late! If financial services are to unlock the value of AI, organisations must move quickly to update AI strategies, address ethical and cultural challenges and build business cases.

There is no doubt that 2023 represents an opportunity and challenge for financial services. If you want to be part of the conversation at Chief Disruptor, join our growing community of business and technology leaders here: https://www.chiefdisruptor.com/membership

If you would like to have your say. Email me at: gabriel.obrien@chiefdisruptor.com

Links:

VMWARE.( 2020). ‘Modern Bank Heists’ Threat Report from VMware Carbon Black Finds Dramatic Increase in Cyberattacks Against Financial Institutions Amid COVID‑19. https://news.vmware.com/releases/modern-bank-heists-threat-report-from-vmware-carbon-black-finds-dramatic-increase-in-cyberattacks-against-financial-institutions-amid-covid-19

Bank of England. (2022). Systemic Risk Survey Results - 2022 H2. https://www.bankofengland.co.uk/systemic-risk-survey/2022/2022-h2

Leave a Comment